How Medicare/ Medicaid In Toccoa, Ga can Save You Time, Stress, and Money.

Since the mid-1970s, development in the price of wellness insurance policy has actually outmatched the surge in genuine earnings, producing a gap in purchasing ability that has added about one million individuals to the rankings of the without insurance each year. Despite the financial success of current years, between 1998 and 1999 there was only a slight decline in the numbers and percentage of without insurance Americans.

Some Ideas on Commercial Insurance In Toccoa, Ga You Should Know

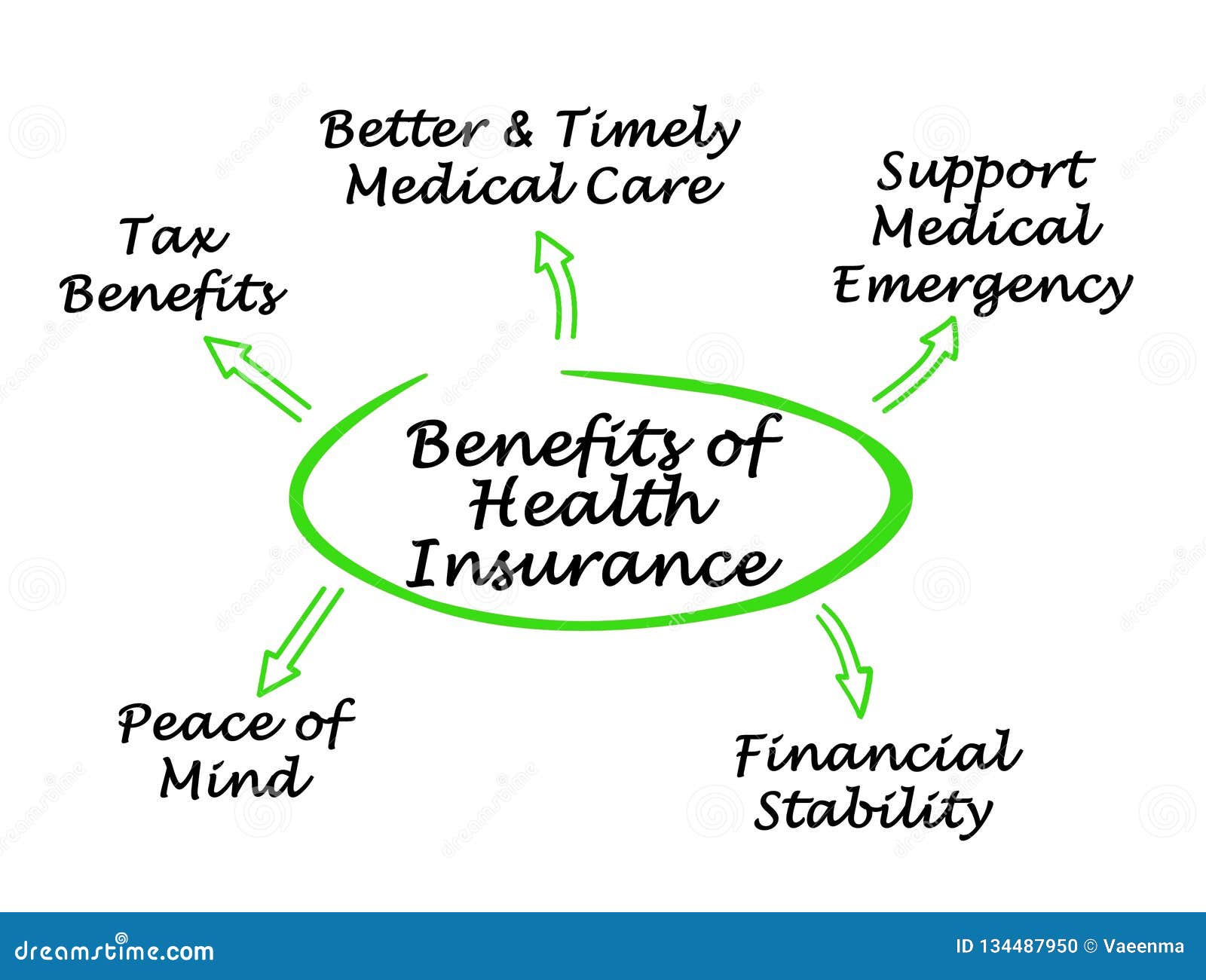

Specifically, recent studies that assessed modifications in states that increased Medicaid compared to those that didn't underscore the value of protection. Adult Medicaid enrollees are five times most likely to have normal resources of treatment and four times more probable to get preventative treatment solutions than people without insurance coverage.

A Biased View of Annuities In Toccoa, Ga

In addition, low-income kids with moms and dads covered by Medicaid are more likely to get well-child gos to than those with without insurance moms and dads. A greater percentage of individuals in Medicaid expansion states have a personal medical professional than those in nonexpansion states. People with coverage are more likely to acquire accessibility to prescription medicine treatments.

Insurance coverage enhancesaccessto behavior health and wellness and substance use problem treatment. Coverage lessens expense barriers to accessing care. Protection expansion is linked with reductions in mortality.

See This Report about Medicare/ Medicaid In Toccoa, Ga

Insurance coverage standing additionally differs by race and ethnic background. The high price of without insurance puts anxiety on the broader health care system. Individuals without insurance coverage placed off needed care and depend a lot more greatly on health center emergency situation divisions, resulting in scarce sources being directed to treat conditions that commonly can have been avoided or handled in a lower-cost setup.

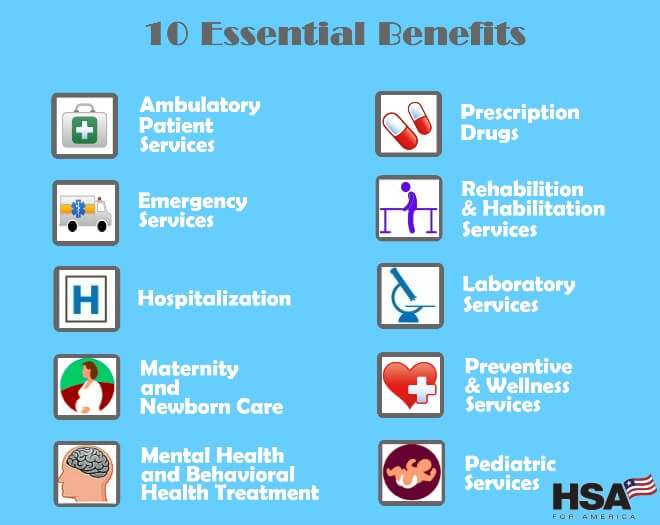

Information regarding where to go online to review and print duplicates of complete health and wellness strategy files Where to discover a checklist of network companies Where to locate prescription medicine protection details Where to find a Glossary of Wellness Insurance Coverage and Medical Terms(additionally called a" Uniform Glossary ") A get in touch with number to call with inquiries A statement on whether the plan satisfies minimal vital insurance coverage(MEC)for the Affordable Treatment Act(ACA)A declaration that it meets minimum value(strategy covers at the very least 60 percent of clinical prices of benefits for a population on average)You can request a copy of an SBC anytime. Discover just how specific wellness insurance plans cover women's health care services, including pregnancy, birth control and abortion. Millions of Americans would certainly have worse health and wellness insurance policy or none at all without Obamacare.

Top Guidelines Of Home Owners Insurance In Toccoa, Ga

Discover just how the Affordable Treatment Act(Obamacare)improved private wellness coverage and delivered plan price through subsidies, Medicaid growth and various other ACA provisions. These options can include clinical, oral, vision, and more. Learn if you are eligible for protection and sign up in a plan through the Market. See if you are qualified to make use of the Medical insurance Industry. There is no revenue limit. To be eligible to register in health and wellness protection with the Industry, you: Under the Affordable Treatment Act(ACA), you have unique person protection when you are insured through the Medical insurance Marketplace: Insurance providers can not decline insurance coverage based on sex or a pre-existing problem. https://urlscan.io/result/60819c54-9ab5-4aa8-9b38-f931574ab718/. The health and wellness treatment law uses rights and securities that make coverage a lot more reasonable and easy to recognize. Some rights and securities relate to plans in the Medical insurance Marketplace or various other specific insurance, some put on job-based strategies, and some use to all health protection. The defenses laid out below may not use to grandfathered medical insurance plans.

With clinical expenses skyrocketing, the requirement for personal health and wellness insurance coverage in this day and age is a financial truth for numerous. Within the find out here classification of private

health health and wellnessInsurance policy there are significant substantial distinctions in between health health and wellness handled CompanyHMO)and a preferred favored supplierCompanyPPO)plan. Of course, the most obvious advantage is that exclusive wellness insurance policy can supply protection for some of your health care expenses.

Many specific plans can cost several hundred bucks a month, and household protection can be even greater - Final Expense in Toccoa, GA (https://dasauge.com/-jim-thomas/#profile). And even the a lot more comprehensive policies come with deductibles and copays that insureds should satisfy before their protection begins

:max_bytes(150000):strip_icc()/derivative_final-fbb671f41d73438a96a5b8a8110145f0.png)

:max_bytes(150000):strip_icc()/InsurancePremium_Final_4194539-be0deecca0684aa68a8a4101b83823f6.png)